This drop in sentiment happened after Bitcoin’s decline below $90,000. Investor confidence was shaken by macroeconomic uncertainties, including trade tariff threats from Donald Trump. Bitcoin investment products also saw $3 billion in outflows over seven days. Meanwhile, Bitcoin miner MARA reported a strong Q4 2024, posting $214.4 million in revenue and growing its Bitcoin holdings to 44,893 BTC.

Crypto Market Sentiment Reaches Extreme Fear

The Crypto Fear & Greed Index, which is a sentiment tracker in the Bitcoin and cryptocurrency market, dropped to its lowest level in over two years after Bitcoin plummeted below $90,000. On Feb. 26, the index slipped further into the “Extreme Fear” zone by reaching a score of 10, which is its lowest point since June of 2022. At that time, the collapse of major crypto players like Three Arrows Capital (3AC), Terraform Labs, and Celsius triggered a wave of market panic.

Crypto fear and greed index (Source: Alternative)

Bitcoin’s recent drop led to renewed concerns among investors. While no major collapses happened in the crypto space in recent days, many analysts attribute the sentiment decline to broader macroeconomic uncertainty. The downturn followed statements from US President Donald Trump, who reaffirmed his plans to impose a 25% tariff on Canada and Mexico. He later extended these measures to include the European Union, which only added to investor concerns.

Bitcoin’s price action over the past 30 days (Source: CoinMarketCap)

Over the past 30 days, Bitcoin’s price fell by close to 16%. As a result, the crypto king was trading hands at around $86,304 at press time. This decline is similar to past market crashes, particularly in mid-2022, when the collapse of the TerraUSD stablecoin led to $60 billion being liquidated from the crypto market. The fallout extended to 3AC, which failed to meet margin calls, ultimately leading to its liquidation by the end of June. Celsius followed soon after by filing for bankruptcy in mid-July.

Despite the ongoing uncertainty, some analysts believe the current conditions may present an opportunity for investors. Ben Simpson, founder of Collective Shift, suggested that historical trends favor buying during periods of extreme fear and selling when the market turns greedy. He pointed out that sentiment has been dampened by unmet expectations regarding Trump’s potential pro-crypto stance, as the president is still occupied with other matters.

Pav Hundal, lead analyst at Swyftx, acknowledged that the market is currently an unforgiving environment, which has been eroding investor confidence. However, he noticed that global liquidity levels have been steadily rising, which is a trend that historically preceded positive price action for Bitcoin. For now analysts expect that the coming weeks will be crucial for the market’s direction.

Crypto Funds Bleed Billions

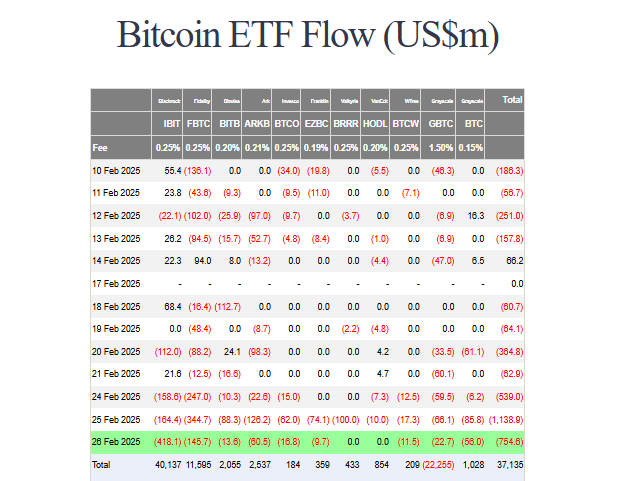

Investors also recently rapidly withdrew funds from crypto investment products, led by a huge $420 million outflow from BlackRock’s iShares Bitcoin Trust. This was the largest single-day exit for the fund. This recent withdrawal is part of a severe seven-day streak, and almost $3 billion exited Bitcoin products overall during this period.

Bitcoin ETF flow (Source: Farside Investors)

The $420 million withdrawn from BlackRock’s iShares Bitcoin Trust on Feb. 26 happened during the current market turmoil, with cryptocurrency investment products experiencing big outflows totaling nearly $3 billion over the past seven trading days. This streak was accentuated by a particularly sharp sell-off on Feb. 24, when combined outflows across major crypto products surpassed $1.1 billion.

Other leading asset managers also saw major exits from their funds, with investors withdrawing sums ranging from $10 million to $60 million from funds managed by Bitwise, Ark 21Shares, Invesco, Franklin, WisdomTree, and Grayscale. Among these, Ark 21Shares and Grayscale witnessed some of the largest investor retreats due to the fears surrounding crypto market instability.

The cumulative effect of investor pullbacks saw the crypto market cap shrink by an additional 5.6% on the day, falling to approximately $2.9 trillion. At press time, the crypto market cap was even lower at $2.86 trillion. Analysts point to heightened macroeconomic uncertainty as a critical factor behind the sudden bearish sentiment.

Despite these turbulent market conditions, crypto market analyst Ki Young Ju said on social media that investors should avoid impulsive selling during downturns, and called panic selling a “novice” mistake. He pointed out that corrections of up to 30% are common in Bitcoin bull cycles, and recalled a 53% decline in 2021 from which Bitcoin eventually recovered to achieve new all-time highs.

Interestingly, the predictions from some market observers have become increasingly bearish due to the ongoing ETF withdrawals. Analyst and BitMEX co-founder Arthur Hayes recently projected that Bitcoin could dip even more, targeting the $70,000 price level amid continued outflows from spot ETFs. Meanwhile, traders specifically singled out the $74,000 support area as a critical price zone, especially after renewed threats from US President Donald Trump regarding more trade tariffs.

Bitcoin Miner MARA Posts Strong Q4

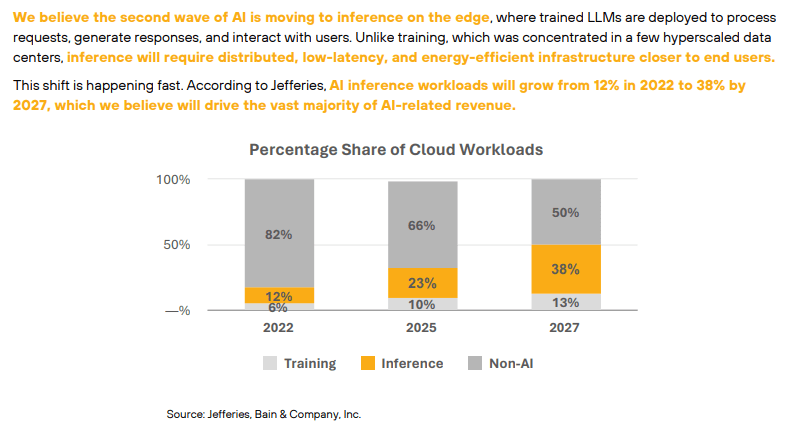

Despite the market turmoil, MARA Holdings is still performing well in Bitcoin mining. In its fourth-quarter 2024 earnings report, the company revealed plans to capitalize on the “second wave” of AI to position itself as a foundational infrastructure provider for AI and high-performance computing applications.

MARA plans to follow a strategy similar to Cisco during the internet boom, by providing essential infrastructure rather than rushing into AI adoption as some competitors did. The firm believes that the greatest opportunities arise not in the initial wave but in the second, when strategic positioning can yield major advantages. While the first wave of AI centered around training large language models in data centers, MARA expects the second wave to focus on inference, where AI models operate independently, making real-time decisions. The company envisions this process looking similar to traditional cloud computing and is positioning itself to supply the necessary infrastructure.

(Source: MARA)

MARA reported a record-breaking $214.4 million in fourth-quarter revenue, which was about 16.5% higher than market expectations. The company also achieved a net income of $528.3 million, which was a 248% year-over-year increase, while adjusted EBITDA surged by 207% to $794.4 million.

In addition to its financial performance, MARA increased its Bitcoin holdings. The firm mined 2,492 Bitcoin during the quarter, retaining all of it under a newly adopted treasury policy. It also acquired 14,574 BTC through cash and proceeds from zero-coupon convertible senior note offerings, bringing its total Bitcoin holdings to 44,893 BTC by the end of 2024. This figure means that MARA is the second-largest corporate Bitcoin holder, behind only MicroStrategy.

The company also prioritized expanding its mining operations by increasing its energized hashrate to 53.2 exahashes per second, a 115% increase from the previous year. A lot of this growth was driven by securing 300% more energy capacity and expanding to seven new mining facilities. Additionally, MARA launched 25-megawatt micro data centers in Texas and North Dakota to reduce its dependence on grid power and enhance operational efficiency.