This means that miners shifted from accumulation to liquidation strategies due to rising operational costs and geopolitical uncertainty. On the other hand, Brazilian fintech Meliuz is doubling down on Bitcoin, and proposed to make BTC its primary strategic asset. Meanwhile, speculation is mounting that a US government acquisition of 1 million BTC, as part of President Trump’s Strategic Bitcoin Reserve plan, could send Bitcoin’s price to $1 million per coin. This could be a turning point in global Bitcoin adoption and monetary policy.

Economic Turmoil Force Miners to Sell Off Bitcoin

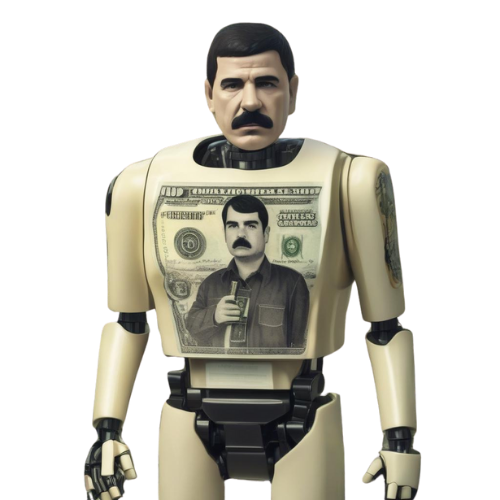

Publicly listed Bitcoin mining companies sold over 40% of the BTC they mined in March, which was the largest monthly liquidation since October of 2024. This mass sell-off signals a major shift in strategy for these firms, who previously focused on accumulating Bitcoin for their treasuries, especially after the last halving event. According to TheMinerMag, the change in behavior is mainly attributed to the challenging macroeconomic climate and increasing operational costs.

Monthly miner liquidations (Source: TheMinerMag)

Because of heightened financial uncertainty, mining firms are offloading big portions of their Bitcoin holdings to cover rising expenses and maintain liquidity. This trend added noticeable selling pressure on the market, and even contributed to a 2.3% drop in Bitcoin’s price during March. This followed a steep 17.39% correction in February.

The situation is being compounded by growing trade tensions and the economic ramifications of US tariff policies under President Donald Trump. These policies led to more expensive supply chains and rising input costs for miners, especially for energy and specialized hardware components. Kristian Csepcsar, the chief marketing officer at Braiins, explained that producing all necessary mining equipment in the US is unfeasible and that Trump’s proposed energy tariffs will only further erode miner profitability.

Jaran Mellerud, CEO of Hashlabs, warned that the economic viability of mining in the United States could be severely impacted if a 24% tariff is imposed on imported mining equipment. He pointed out that such tariffs will make US mining operations a lot more expensive compared to countries like Finland, which are not subject to the same trade barriers.

In a recent X post, Mellerud predicted that hardware suppliers will likely begin rerouting shipments away from the US to more affordable markets, allowing foreign competitors to gain market share while American firms face declining margins and increasing pressure.

So far, these developments paint a bleak outlook for the US mining industry, which may continue to lose ground globally if trade and energy policy uncertainties persist. The strategic pivot from accumulation to liquidation among miners is a direct reflection of the financial pressures currently bearing down on the industry.

Brazilian Fintech Meliuz Eyes Bitcoin Expansion

While US miners are getting rid of their Bitcoin, other companies are planning on stocking up on the crypto king. Brazilian fintech firm Meliuz recently announced plans to expand its Bitcoin holdings and designate the cryptocurrency as its primary strategic asset, pending shareholder approval.

The company is well known for its cashback and financial services, and will present this proposal during a shareholder meeting that is scheduled for May 6. While Meliuz explained that its core operations will stay the same, it sees the generation of operational cash as a key vehicle for steadily acquiring more Bitcoin over time.

If approved, the shift will position Bitcoin at the center of Meliuz’s treasury strategy. The firm also hinted at additional initiatives that are aimed at generating more Bitcoin for shareholders, potentially through financial transactions and broader strategic efforts. Shareholders opposed to this direction, and who held shares before April 14, are entitled to seek reimbursement.

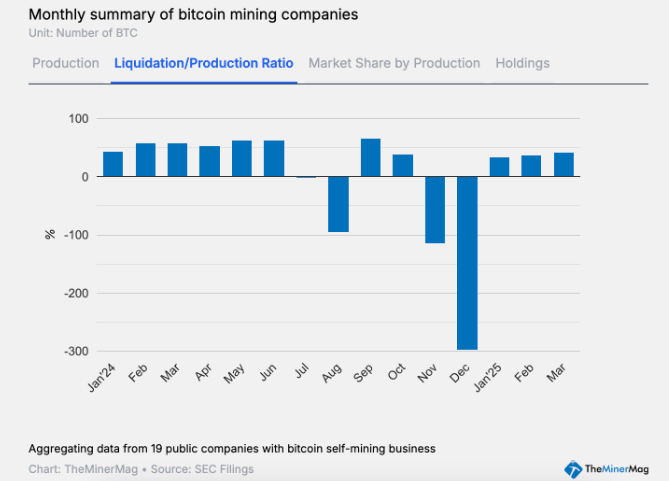

Meliuz stock price over the past 5 days (Source: Google Finance)

After the announcement was made, Meliuz’s stock surged by over 14% in a single trading session, rising from 3.28 to 3.76 Brazilian reals on the Brazilian Stock Exchange. Over a five-day period, the share price increased more than 29%.

Meliuz first dipped into Bitcoin in March, when it used up to 10% of its cash reserves to buy 45 BTC for approximately $4.1 million. The firm was one of twelve publicly listed companies that added Bitcoin to their balance sheets for the first time in the first quarter of 2025, joining some other companies like Rumble.

According to Bitwise, public companies collectively increased their Bitcoin holdings by 16.1% in Q1 2025 by buying around 95,431 BTC and raising the total to approximately 688,000 BTC held across corporate treasuries.

US Bitcoin Reserve Could Trigger $1M BTC

A potential Bitcoin price surge to $1 million was floated by Zach Shapiro, the head of policy at the Bitcoin Policy Institute (BPI), during a recent appearance on the Bitcoin Magazine podcast. Shapiro speculated that if the United States were to announce the purchase of one million Bitcoin, the market reaction will be nothing short of seismic, and could drive the price of Bitcoin to unprecedented levels. He suggested that such a move will instantly send the cryptocurrency soaring, potentially reaching the $1 million mark per coin in a short span of time.

The discussion stems from President Donald Trump’s executive order that was issued on March 7, which established a Strategic Bitcoin Reserve and a Digital Asset Stockpile. The main goal of this initiative is to position the US as a global leader in the Bitcoin space.

Bitcoin Magazine podcast (Source: YouTube)

Matthew Pines, executive director of BPI, said that the rest of the world is closely monitoring the United States’ approach to Bitcoin. He stated that in order to fulfill Trump’s promise of becoming a Bitcoin superpower, the US has to increase its Bitcoin holdings significantly. According to Pines, the size of the country’s Bitcoin reserve is a direct reflection of its commitment to that objective.

The executive order directs the Treasury and Commerce Departments to explore “budget-neutral” strategies to buy Bitcoin, ensuring that the expansion of the strategic reserve does not place more burdens on taxpayers. Senator Cynthia Lummis agreed with this sentiment by reintroducing the BITCOIN Act on March 12, which seeks to raise the federal government’s Bitcoin holdings to over one million BTC.

To meet these ambitious targets, Pines proposed several revenue sources the government could use to acquire Bitcoin without raising taxes. These include tariff revenues, royalties from oil and gas leases, proceeds from the sale of federal land, physical gold, and even other digital assets.

The idea aligns with one of President Trump’s latest executive actions on April 2, which imposed a baseline 10% tariff on all imports, with reciprocal measures for countries taxing US exports. While this policy aims to boost domestic economic strength, it has also contributed to uncertainty in global markets.

It is no surprise that the idea of the United States making such a large-scale Bitcoin purchase sparked debate about the broader implications for financial sovereignty, global positioning, and digital asset adoption. If the proposal were ever implemented, it could dramatically alter the trajectory of the Bitcoin market.